San Antonio Real Estate Market Trends 2024

Last Updated:

As we explore the San Antonio real estate market for September 2024, it’s important for investors to understand the current trends impacting their strategies. This month offers a range of opportunities, making it an important time to evaluate the landscape. Also Read: The Texas Housing Real Estate Market Forecast in 2024

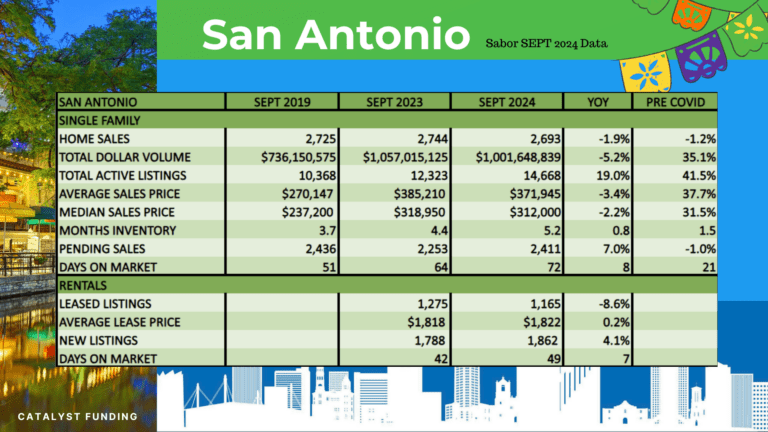

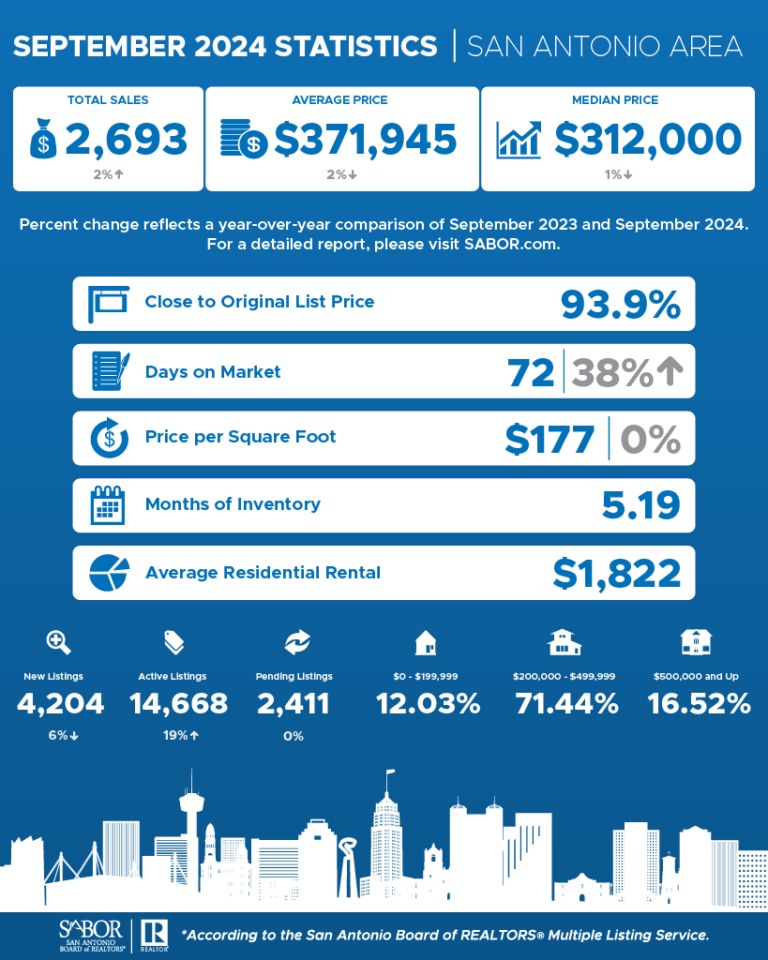

San Antonio Key Market Highlights

Key Market Highlights

- Median Home Price: $299,863

- Price Per Square Foot Change: Down 0.9% from August

- Total Listings: 7,055 homes (down 3% from last month)

- Year-Over-Year Inventory Increase: 27% higher than September 2023

- Average Days on Market: 64 days (up 5 days from last month)

“Overall, total property sales increased by 8.7 percent, and total dollar volume jumped 13.8 percent to $4 billion. Active listings were up 32.3 percent from April 2023.”

San Antonio Single Family Home Market Snapshot

Home Prices: A Seasonal Adjustment

- Seasonal Price Trends: September typically sees a reduction in home prices, aligning with historical trends in the San Antonio real estate market.

- Opportunity for Investors: Adjusted prices create potential for acquisitions at favorable costs, making this an ideal time for real estate investment opportunities.

Inventory Insights: Increased Options

- Decreased Listings: While total listings decreased by 3%, the inventory remains significantly higher compared to last year.

- Competitive Market: More available properties offer investors a wider selection of potential investment opportunities, which is particularly beneficial for those focused on rental property investment.

Selling Times: Stable Market Pace

- Average Time on Market: Homes are taking an average of 64 days to sell.

- Buyers Market: This is becoming more of a buyers market which allows buyers of distressed properties to get great deals.

5 Financing Keys to Build Your Real Estate Portfolio

Our 5 most important financing pointers to help you accomplish your goals in real estate

Financing Real Estate Investments with Catalyst Funding

Financing Your Investments with Catalyst Funding

To maximize your investment potential in the San Antonio market, access to effective financing is essential. Catalyst Funding is your one-stop shop for hard money loans and permanent financing in San Antonio.

Hard Money Loans:

o Quick access to capital for property purchases and renovations.

o Fast approval processes and competitive rates make it easier for investors to act quickly.

Permanent Financing:

o Options for refinancing or acquiring new rental properties.

o Expert guidance to find the best financing terms tailored to your investment needs.

Strategic Opportunities for Investors

- Acquire Below-Market Properties: Take advantage of lower prices to purchase properties that may require renovations, enhancing your investment potential.

- Focus on Rental Properties: Increased inventory allows for finding properties that cater to rising rental demand in San Antonio, making them attractive options for income generation.

- San Antonio has the best home price to rent ratio of all the major metros in Texas!

- Consider a Long-Term Hold Strategy: Properties in desirable neighborhoods can appreciate significantly over time, providing a stable return on investment.

- Stay Informed: Utilize market analytics and network with local professionals to gain insights into the San Antonio real estate market.

San Antonio Real Estate Market 2025

San Antonio’s real estate market in 2025 presents a strong investment opportunity, driven by steady population growth, affordability, and economic stability. With increasing demand for both rental properties and homes, investors have numerous profitable prospects to consider. Early reports from industry experts reveal a rise in home sales activity, even as prices temporarily decline, offering potential bargains for savvy buyers. This active market, combined with a favorable balance of supply and demand, suggests long-term growth potential. Stay updated with monthly insights on San Antonio’s evolving real estate market here!

Dallas Real Estate Market Trends 2025

Dallas’ real estate market in 2025 is shaping up to be a hotbed for investment, driven by rapid population growth, a thriving economy, and expanding job opportunities. Demand for both rentals and homes for sale is surging, offering attractive returns for investors. Industry experts are reporting increased activity in single-family home sales, with strong performance across various price ranges. This balanced, high-growth market positions Dallas as a prime spot for real estate investment. Keep up with monthly updates on the Dallas real estate market here!

Houston Real Estate Market 2025

Houston’s real estate market in 2025 presents a strong investment opportunity fueled by steady population growth, economic diversity, and competitive living costs. With rising demand for both rental properties and homes, investors have plenty of profitable prospects to explore. Early reports from industry experts show a surge in single-family home sales and vibrant activity across various price points. This healthy balance of supply and demand points to continued growth. Stay informed with monthly updates on Houston’s dynamic real estate market here!

Catalyst Funding: Areas We Serve as a Trusted Hard Money Lender

Looking for fast, reliable funding to invest in top Texas markets like Houston, Dallas, San Antonio, or Austin? Catalyst Funding is a trusted hard money lender serving real estate investors across Texas, including Houston, Dallas, San Antonio, and Austin. We offer fast, flexible hard money loans for property acquisitions, renovations, and long-term investments. Our expert team provides tailored financing solutions such as bridge loans, rental property loans, and cash-out refinances. With quick turn times, dedicated loan officers, and a secure borrower portal, Catalyst Funding helps investors close deals efficiently and grow their portfolios. Learn how we can support your real estate investment success today!