San Antonio Real Estate Market 2025

- Updated:

- 6 Minute Read

January 2025: Price Drops, High Activity, and New Opportunities in San Antonio Real Estate Market

The San Antonio real estate market is telling a different story compared to other cities like Houston and Dallas. While those markets are seeing modest price increases, San Antonio has experienced a notable decline. Let’s break down the key insights from the latest update on this market. We were joined by our special guest, Steven Curtis, Chief Production Officer at NRL Mortgage to go over the data! Let’s break down the key points from our recent market analysis to understand what’s driving this growth.

Key Takeaways

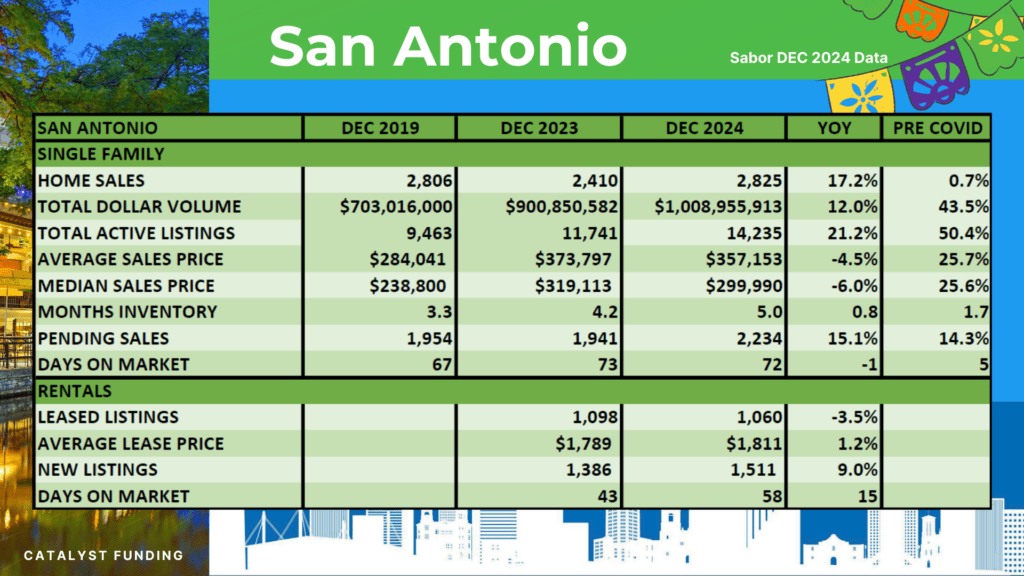

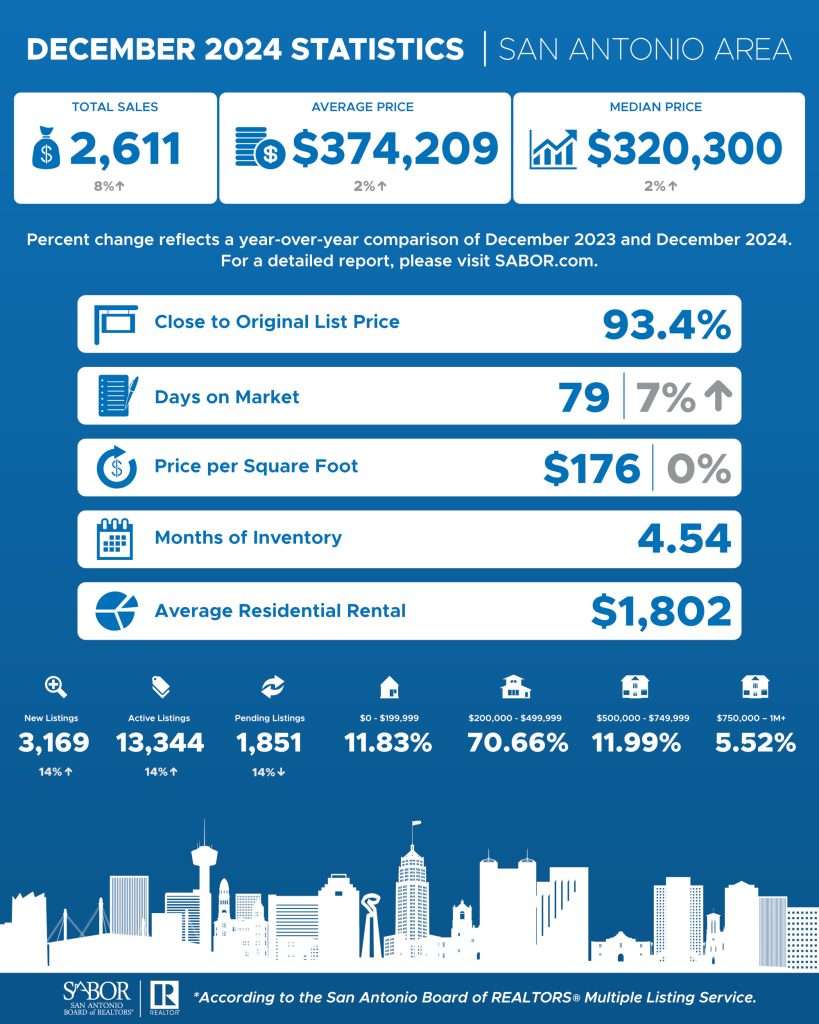

- Price Decline but High Activity: San Antonio’s median price is down 6%, and average price is down 4.5%. Despite price drops, market is still active with 17.2% more homes sales year over year.

- Affordability Advantage: Household incomes in San Antonio are comparable to those in Houston, but home prices are significantly lower.

- Strong Demand Supports Investment: Investors may find opportunities to buy properties at lower prices due to current conditions.

- Permitted Compliance is Crucial: San Antonio has a strict “strike team” enforcing compliance with permitting requirements. Investors with a solid process and proper permitting may benefit from reduced competition and lower acquisition costs.

- Strategic Opportunity for Prepared Investors: The combination of lower prices, high sales activity, and affordability makes San Antonio a promising market for long-term investment.

Sales Trends

- Total Dollar Volume increased to $1.08 billion, a 12% increase from the previous year.

- Increased Sales: Single-family home sales rose by an impressive 17.2% year-over-year, totaling 2,825 units sold in December 2024 compared to 2,410 units sold in December 2023.

- Average Sales Price decreased to $357,153, representing a reduction in the average at -4.5% year-over-year.

- Pending Sales in December 2024 were at a total of 2,234 pending transactions, up 15.1% compared to last year.

This level of activity can actually work in your favor, especially if you’re in the business of flipping or holding rental properties.

An active market means it’s easier to find comparable sales (comps), which can help you price and sell properties with greater accuracy. The key takeaway? Prices might be lower, but demand hasn’t faded.

Affordability and Opportunity in San Antonio

One of the strongest advantages in the San Antonio’s real estate market is affordability. Household incomes in San Antonio are comparable to those in Houston, but home prices are significantly lower. This creates an attractive environment for both homebuyers and investors. Whether you’re looking to buy a personal residence or acquire investment properties, the numbers are in your favor!

Inventory & Market Conditions

- Months of Inventory: Increased to 5.0 months, signaling a shift toward market balance.

- Days on Market: Averaged 72 days, a slight improvement from 73 days the previous year.

Rental Market

- Leased Listings: Decreased 3.5% YoY to 1,060.

- Average Lease Price: Increased 1.2% YoY to $1,811.

- New Rental Listings: Rose 9% YoY, indicating more rental options coming to market.

- Days on Market for Rentals: Jumped to 58 days, 15 days longer than last year.

These figures reflect a dynamic market with declining prices but heightened activity, presenting opportunities for both investors and buyers in 2025.

San Antonio’s real estate market in December 2024 shows heightened sales activity and increased inventory, despite declining home prices, signaling both opportunities and challenges for investors and buyers in 2025.

San Antonio's Market: Investment and Development Hotspots

Certain areas of the San Antonio real estate market are standing out as prime opportunities for investors and developers:

- Cibolo: This area is showing significant growth potential, with a 54.0% increase in dollar volume for residential properties. This surge points to rising market confidence and increased investor interest.

- Universal City: Known for its proximity to military installations, Universal City showcases strong market stability, evidenced by a 15.8% rise in median home prices. This suggests steady demand and ongoing appeal for both buyers and investors.

5 Financing Keys to Build Your Real Estate Portfolio

Our 5 most important financing pointers to help you accomplish your goals in real estate!

Catalyst Funding can provide the perfect financial solution for your investment needs.

Whether you’re investing in Houston, Dallas, San Antonio, Austin, or any other area in Texas, we’ve got you covered!

Why Choose Catalyst Funding as Your Hard Money Lender?

Here’s why San Antonio real estate market investors trust Catalyst Funding for their lending needs:

- Experienced Team: Our team members are seasoned investors who understand the challenges and opportunities in real estate. We’ve facilitated thousands of successful transactions across Texas.

- Dedicated Loan Officers: You’ll have a single point of contact to guide you through the process, making your experience efficient and stress-free.

- Quick Turnaround: Time is money in the San Antonio real estate market! Our fast turn times ensure you can act quickly to secure deals and complete projects.

- Technology-Driven Solutions: Manage your account from anywhere with our secure borrower portal, designed for mobile access and real-time updates.

- Proven Success: Our 5-star ratings on Google and social media platforms reflect the high level of service and results we provide to our clients.

Get Started with Catalyst Funding - Today!

Ready to unlock new opportunities with Texas real estate investments? Catalyst Funding offers hard money loans and financing solutions tailored to your needs. Whether you’re investing in Houston, Dallas, San Antonio, Austin, or elsewhere in Texas, we’re here to help you achieve your goals.

Reach out to Catalyst Funding and start investing with confidence:

- Apply Now!

- Call us: 832.699.6960

- Connect with us on social media: Facebook | Instagram | Twitter | LinkedIn

Let Catalyst Funding be your go-to source for reliable hard money lending solutions. Together, we can build your success in real estate investing!

Dallas Real Estate Market Trends 2025

Dallas’ real estate market in 2025 is shaping up to be a hotbed for investment, driven by rapid population growth, a thriving economy, and expanding job opportunities. Demand for both rentals and homes for sale is surging, offering attractive returns for investors. Industry experts are reporting increased activity in single-family home sales, with strong performance across various price ranges. This balanced, high-growth market positions Dallas as a prime spot for real estate investment. Keep up with monthly updates on the Dallas real estate market here!

Houston Real Estate Market 2025

Houston’s real estate market in 2025 presents a strong investment opportunity fueled by steady population growth, economic diversity, and competitive living costs. With rising demand for both rental properties and homes, investors have plenty of profitable prospects to explore. Early reports from industry experts show a surge in single-family home sales and vibrant activity across various price points. This healthy balance of supply and demand points to continued growth. Stay informed with monthly updates on Houston’s dynamic real estate market here!

Catalyst Funding: Areas We Serve as a Trusted Hard Money Lender

Looking for fast, reliable funding to invest in top Texas markets like Houston, Dallas, San Antonio, or Austin? Catalyst Funding is a trusted hard money lender serving real estate investors across Texas, including Houston, Dallas, San Antonio, and Austin. We offer fast, flexible hard money loans for property acquisitions, renovations, and long-term investments. Our expert team provides tailored financing solutions such as bridge loans, rental property loans, and cash-out refinances. With quick turn times, dedicated loan officers, and a secure borrower portal, Catalyst Funding helps investors close deals efficiently and grow their portfolios. Learn how we can support your real estate investment success today!

Hard Freeze Survival Guide: Weatherproofing Your Texas Investment Property

Texas investment properties, especially in warmer regions, are typically built with minimal insulation against freezing temperatures. Here are some great tips and tricks to help weatherproof your investment property and keep it from incurring damages from a hard freeze or winter weather event!