Texas Real Estate Market Trends 2024

Last Updated:

Texas Housing Market Update: Insights for Real Estate Investors

Outlook for the Texas Economy

Our most recent webinar was an informative session led by Catalyst Funding’s industry experts: CEO, Wade Comeaux and Director of Lending Jeff Johnson with our special guest, Jennifer McCormick, Single-family Sales Manager at Lifestyles Realty, Inc.

This article includes some of the best segments of the webinar, allowing you to get an overview of topics that interest you most. Watch the entire presentation here:

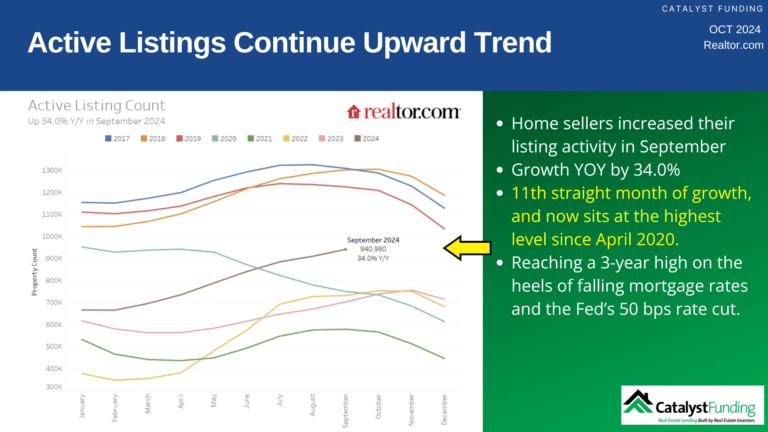

Active Listings Continue Upward Trend

A key highlight is the significant increase in active listings. There were 34% more homes for sale compared to the same time last year, marking the 11th consecutive month of annual inventory growth. This trend has brought the inventory to its highest level since early 2020, driven by a combination of lower mortgage rates and a recent 50 basis point cut by the Federal Reserve. For investors, this expanded inventory offers a broader selection of properties, making it an ideal moment for property loans or hard money loans to finance purchases.

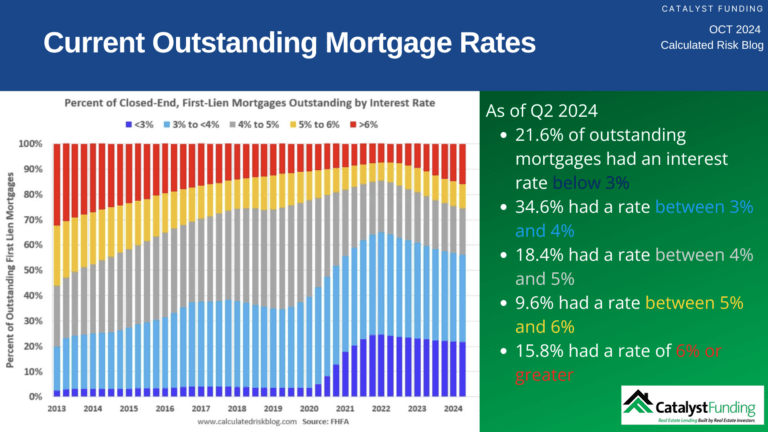

Current Outstanding Mortgage Rates

As of the second quarter of 2024, the landscape of outstanding mortgage rates shows that a significant portion of homeowners are benefiting from historically low rates. Specifically, 21.6% of outstanding mortgages have an interest rate below 3%, while 34.6% fall within the 3% to 4% range. Additionally, 18.4% have rates between 4% and 5%. A smaller segment of 9.6% holds rates between 5% and 6%, and 15.8% have rates of 6% or greater. This distribution suggests that many current homeowners may be reluctant to sell, potentially limiting supply. Investors should consider this dynamic when strategizing their acquisitions, as lower inventory could drive competition and prices higher.

“For savvy investors, understanding the implications of cash-out refinances and how they can help homeowners leverage their equity to make additional purchases is essential.”

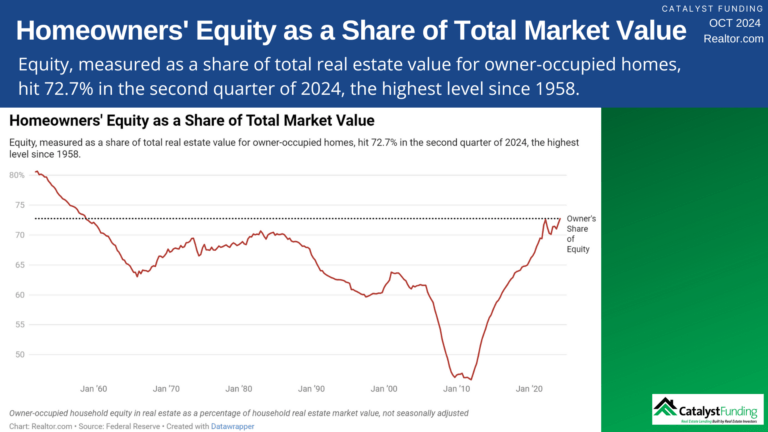

Homeowners' Equity at Historic Highs

Affordability Index and Investment Opportunities

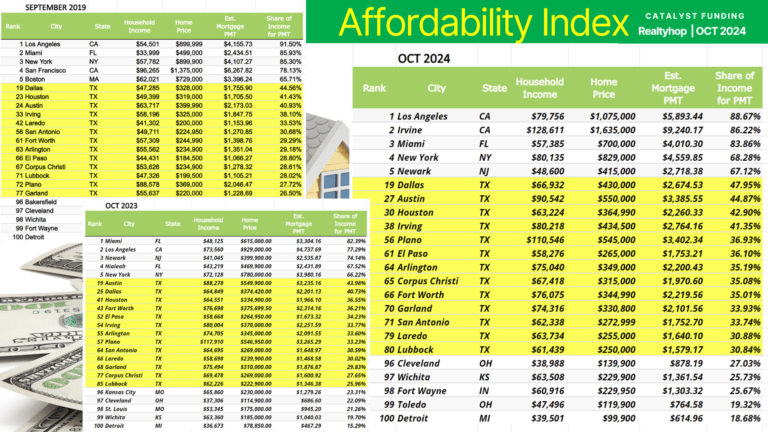

Despite positive signs, affordability remains a pressing concern in many urban areas. However, if you’re ready to explore vibrant cities with a lower cost of living, consider the charm of Dallas, Houston, and Austin—where your dollar goes further compared to places like Los Angeles and Miami! Plus, San Antonio has emerged as a hidden gem, offering incredible buying opportunities and making it an ideal spot for affordable living. The RealtyHop Housing Affordability Index highlights these opportunities and analyzes projected median household income, median listing prices, local property taxes, and mortgage expenses. This analysis provides a comprehensive overview of potential investment returns across the nation’s most populous cities, underscoring the importance of strategic real estate lending approaches.

Article References

Active Listings Continue Upward Trend (Realtor.com)

Current Outstanding Mortgage Rates (Calculated Risk)

Homeowners’ Equity at Historic Highs (Realtor.com)

Affordability Index and Investment Opportunities (Realty Hop)

San Antonio Real Estate Market 2025

San Antonio’s real estate market in 2025 presents a strong investment opportunity, driven by steady population growth, affordability, and economic stability. With increasing demand for both rental properties and homes, investors have numerous profitable prospects to consider. Early reports from industry experts reveal a rise in home sales activity, even as prices temporarily decline, offering potential bargains for savvy buyers. This active market, combined with a favorable balance of supply and demand, suggests long-term growth potential. Stay updated with monthly insights on San Antonio’s evolving real estate market here!

Dallas Real Estate Market Trends 2025

Dallas’ real estate market in 2025 is shaping up to be a hotbed for investment, driven by rapid population growth, a thriving economy, and expanding job opportunities. Demand for both rentals and homes for sale is surging, offering attractive returns for investors. Industry experts are reporting increased activity in single-family home sales, with strong performance across various price ranges. This balanced, high-growth market positions Dallas as a prime spot for real estate investment. Keep up with monthly updates on the Dallas real estate market here!

Houston Real Estate Market 2025

Houston’s real estate market in 2025 presents a strong investment opportunity fueled by steady population growth, economic diversity, and competitive living costs. With rising demand for both rental properties and homes, investors have plenty of profitable prospects to explore. Early reports from industry experts show a surge in single-family home sales and vibrant activity across various price points. This healthy balance of supply and demand points to continued growth. Stay informed with monthly updates on Houston’s dynamic real estate market here!

Catalyst Funding: Areas We Serve as a Trusted Hard Money Lender

Looking for fast, reliable funding to invest in top Texas markets like Houston, Dallas, San Antonio, or Austin? Catalyst Funding is a trusted hard money lender serving real estate investors across Texas, including Houston, Dallas, San Antonio, and Austin. We offer fast, flexible hard money loans for property acquisitions, renovations, and long-term investments. Our expert team provides tailored financing solutions such as bridge loans, rental property loans, and cash-out refinances. With quick turn times, dedicated loan officers, and a secure borrower portal, Catalyst Funding helps investors close deals efficiently and grow their portfolios. Learn how we can support your real estate investment success today!