Dallas Real Estate Market Trends 2025

- Updated:

- 6 Minute Read

January 2025: Dallas Real Estate Market Shines as a Top Performer

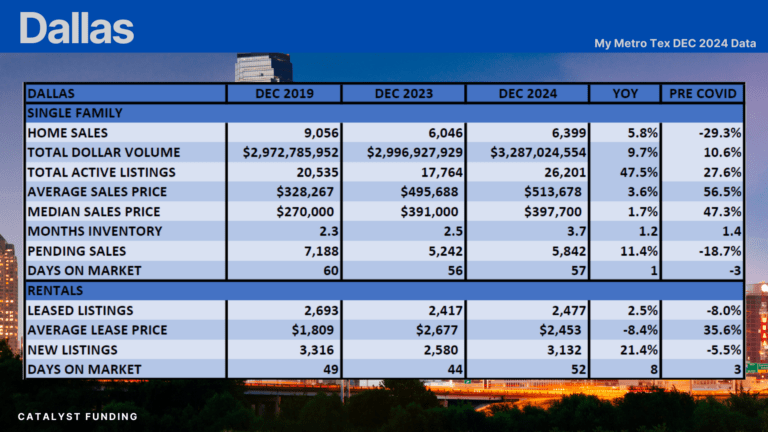

The Dallas real estate market closed out 2024 with Dallas standing tall as one of the most robust performers among major Texas cities. While markets like Austin, Houston, and San Antonio experienced growth, Dallas surged ahead with impressive price appreciation and competitive market dynamics. We were joined by our special guest, Steven Curtis, Chief Production Officer at NRL Mortgage to provide some great insight to the data! Let’s break down the key trends and insights that shaped Dallas’s real estate market success.

Key Takeaways

- Exceptional Price Growth: Sales prices increased by 56.5% (average) and 47.3% (median) since COVID, outpacing other Texas markets.

- Strong Market Fundamentals: Dallas has the lowest days on market and inventory levels, indicating a competitive seller’s market.

- Corporate Relocation Boost: Major corporate moves and job growth have driven demand and price increases.

- Temporary Rental Dip: Rental prices dropped by 8% due to a 21% increase in listings, but this is expected to be short-lived.

- Buy-and-Hold Opportunities: Investors find better cash flow in suburbs and areas north of Dallas with lower property prices.

- Regional Leader: Dallas leads in long-term price appreciation compared to Houston, Austin, and San Antonio.

Appreciation Boom: Dallas Real Estate Tops TX Market in Long-Term Growth

Over the last five years, Dallas has enjoyed extraordinary price appreciation in both average and median sales prices. Since the onset of the COVID-19 pandemic, prices have increased by approximately 56.5% and 47.3% for average and median values, respectively. This marks Dallas as a market leader, surpassing even Austin, which had garnered a lot of investor hype in recent years.

Key Metrics for January 2025

Sales Trends

- Total Dollar Volume: $3.29B, up 9.7% Year Over Year and 10.6% since pre-COVID.

- Total Home Sales: 6,399 in Dec 2024, up 5.8% Year Over Year but down 29.3% compared to pre-COVID (Dec 2019).

- Average Sales Price: $513,678, up 3.6% Year Over Year and 56.5% since pre-COVID. That is a huge spike in sales price in only five years for the Dallas real estate market area.

- Active Listings: 26,201, a 47.5% Year Over Year increase and 27.6% above pre-COVID levels.

Market Strength: Low Inventory, Faster Sales

The metrics in the Dallas real estate market really showcase its strength as the top metro for real estate in Texas going into 2025. The city boasts the lowest days on market among any other Texas major metros, signaling a fast moving market.

In addition, the months of inventory remains tight emphasizing the high demand for homes. These indicators position Dallas as a seller’s market, with buyers facing stiff competition for available properties.

- Months of Inventory: Only 3.7 months of inventory available, up from 2.5 months in Dec 2023, indicating increasing supply.

- Pending Sales: 5,842, up 11.4% Year Over Year but 18.7% lower than pre-COVID.

- Days on Market: 57, up by 1 day Year Over Year but 3 days shorter than in 2019.

Dallas Buy & Hold Strategies: Opportunities Beyond the City Core

With property prices in Dallas pushing half a million dollars, cash flow potential for buy-and-hold investors has tightened. Yet, opportunities remain abundant in areas further from the city center.

North of Dallas: Areas near the Oklahoma border offer more affordable properties with healthy rental demand.

Plano & Frisco: Corporate hubs in these areas provide excellent job access and attract renters seeking shorter commutes.

Fort Worth & Surrounding Suburbs: Investors have found success in suburbs where property prices are lower, yet rental yields remain strong.

Lending partners like Catalyst Funding and NRL are actively supporting investors in these regions, ensuring access to financing for both flips and long-term rental investments.

Catalyst Funding can provide the perfect financial solution for your investment needs.

Whether you’re investing in Houston, Dallas, San Antonio, Austin, or any other area in Texas, we’ve got you covered!

Why Choose Catalyst Funding as Your Hard Money Lender?

Here’s why Dallas real estate market investors trust Catalyst Funding for their lending needs:

- Experienced Team: Our team members are seasoned investors who understand the challenges and opportunities in real estate. We’ve facilitated thousands of successful transactions across Texas.

- Dedicated Loan Officers: You’ll have a single point of contact to guide you through the process, making your experience efficient and stress-free.

- Quick Turnaround: Time is money in the Dallas real estate market! Our fast turn times ensure you can act quickly to secure deals and complete projects.

- Technology-Driven Solutions: Manage your account from anywhere with our secure borrower portal, designed for mobile access and real-time updates.

- Proven Success: Our 5-star ratings on Google and social media platforms reflect the high level of service and results we provide to our clients.

Get Started with Catalyst Funding - Today!

Ready to unlock new opportunities with Texas real estate investments? Catalyst Funding offers hard money loans and financing solutions tailored to your needs. Whether you’re investing in Houston, Dallas, San Antonio, Austin, or elsewhere in Texas, we’re here to help you achieve your goals.

Reach out to Catalyst Funding and start investing with confidence:

- Apply Now!

- Call us: 832.699.6960

- Connect with us on social media: Facebook | Instagram | Twitter | LinkedIn

Let Catalyst Funding be your go-to source for reliable hard money lending solutions. Together, we can build your success in real estate investing!

San Antonio Real Estate Market 2025

San Antonio’s real estate market in 2025 presents a strong investment opportunity, driven by steady population growth, affordability, and economic stability. With increasing demand for both rental properties and homes, investors have numerous profitable prospects to consider. Early reports from industry experts reveal a rise in home sales activity, even as prices temporarily decline, offering potential bargains for savvy buyers. This active market, combined with a favorable balance of supply and demand, suggests long-term growth potential. Stay updated with monthly insights on San Antonio’s evolving real estate market here!

Houston Real Estate Market 2025

Houston’s real estate market in 2025 presents a strong investment opportunity fueled by steady population growth, economic diversity, and competitive living costs. With rising demand for both rental properties and homes, investors have plenty of profitable prospects to explore. Early reports from industry experts show a surge in single-family home sales and vibrant activity across various price points. This healthy balance of supply and demand points to continued growth. Stay informed with monthly updates on Houston’s dynamic real estate market here!

Catalyst Funding: Areas We Serve as a Trusted Hard Money Lender

Looking for fast, reliable funding to invest in top Texas markets like Houston, Dallas, San Antonio, or Austin? Catalyst Funding is a trusted hard money lender serving real estate investors across Texas, including Houston, Dallas, San Antonio, and Austin. We offer fast, flexible hard money loans for property acquisitions, renovations, and long-term investments. Our expert team provides tailored financing solutions such as bridge loans, rental property loans, and cash-out refinances. With quick turn times, dedicated loan officers, and a secure borrower portal, Catalyst Funding helps investors close deals efficiently and grow their portfolios. Learn how we can support your real estate investment success today!

Hard Freeze Survival Guide: Weatherproofing Your Texas Investment Property

Texas investment properties, especially in warmer regions, are typically built with minimal insulation against freezing temperatures. Here are some great tips and tricks to help weatherproof your investment property and keep it from incurring damages from a hard freeze or winter weather event!