Dallas Real Estate Market Trends 2024

Last Updated:

Dallas Real Estate Market Update: September 2024 Insights for Investors

The Dallas real estate market in September 2024 has shown interesting trends that are crucial for investors to understand. This month’s data reveals shifts in home prices, inventory levels, and sales dynamics. Here’s a detailed look at the key numbers and trends impacting real estate investors.

October 2024 Market Update

Tune in and stay up to date with the current real estate investment market.

We will be led by Catalyst Funding’s industry experts, CEO Wade Comeaux and our Director of Lending, Jeff Johnson.

Let’s dive into:

- National and Texas leading indicators

- Recent numbers for San Antonio, Houston, Dallas, and Austin

- Lending Updates and Today’s rates

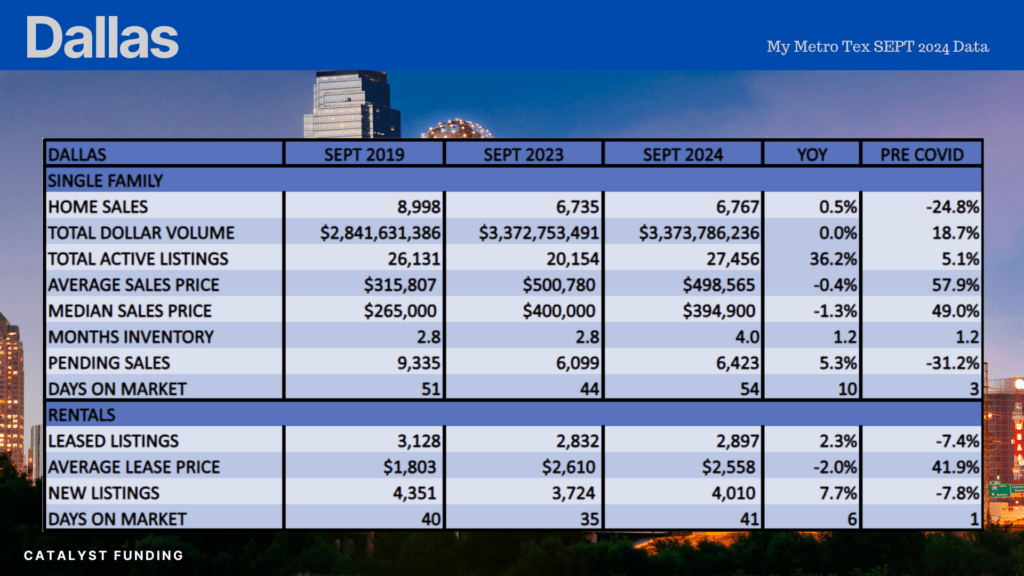

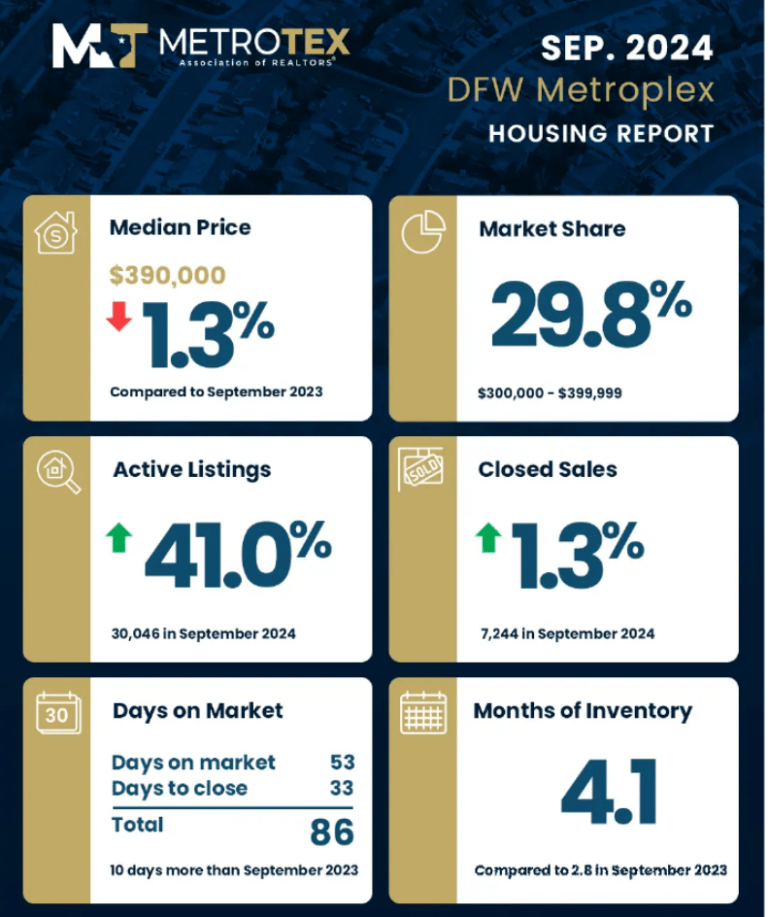

Dallas Real Estate Market: Key Market Metrics for September 2024

- Median Listing Price: $450,000

This represents a slight increase from the previous month, bucking the usual trend of declining prices in September. - Price Per Square Foot: Stable

The price per square foot remained consistent with August, indicating a stabilization in home values amid market fluctuations.

Inventory Growth

- Total Homes for Sale: 4,013

This is a 5% increase from August and a significant 58% increase compared to September 2023. The surge in inventory provides investors with more options and potential deals. - New Listings: 1,486

This reflects a 14% increase from last month and a 19% increase year-over-year, highlighting the growing opportunities for investment.

Sales Dynamics

- Average Days on Market: 51 days

Homes in Dallas are taking an average of 51 days to sell, which is 2 days longer than last month and 10 days longer than September 2023, suggesting an easier market for buyers of distressed properties.

Insights for Real Estate Investors

- Increased Inventory: With 4,013 homes for sale, investors can take advantage of a broader selection of properties, making it an ideal time to explore various investment opportunities in the Dallas real estate market.

- Focus on Rental Properties: Consider the long-term potential of rental properties in a market that is stabilizing. Analyze areas with high rental demand to maximize your investment returns.

- Monitor Long-Term Trends: Despite current market fluctuations, the steady job growth, income growth and population increase in Dallas bode well for sustained investment opportunities.

Conclusion

September 2024 presents a compelling scenario for investors in the Dallas real estate market.

Catalyst Funding: Your Trusted Hard Money Lender in Dallas

As you navigate the Dallas real estate landscape, Catalyst Funding is here to assist you. As a leading hard money lender in Dallas, we specialize in providing fast and flexible real estate investment loans tailored to your unique needs. Our quick application process and streamlined funding solutions empower you to seize opportunities as they arise.

Benefits of Choosing Catalyst Funding

- Quick Approval: We offer swift approval for hard money loans, allowing you to move quickly on investment opportunities.

- Flexible Terms: Our loans are designed to accommodate the specific needs of real estate investors, whether for purchasing, refinancing, or renovating properties.

- Expert Guidance: With our expertise in the Dallas market, we provide insights that help you make informed investment decisions.

Contact Catalyst Funding today to discover how we can support your real estate investment financing needs and help you capitalize on the current market opportunities. As your trusted advisor for real estate investment loans, we are committed to helping you succeed in your investment journey.

San Antonio Real Estate Market 2025

San Antonio’s real estate market in 2025 presents a strong investment opportunity, driven by steady population growth, affordability, and economic stability. With increasing demand for both rental properties and homes, investors have numerous profitable prospects to consider. Early reports from industry experts reveal a rise in home sales activity, even as prices temporarily decline, offering potential bargains for savvy buyers. This active market, combined with a favorable balance of supply and demand, suggests long-term growth potential. Stay updated with monthly insights on San Antonio’s evolving real estate market here!

Dallas Real Estate Market Trends 2025

Dallas’ real estate market in 2025 is shaping up to be a hotbed for investment, driven by rapid population growth, a thriving economy, and expanding job opportunities. Demand for both rentals and homes for sale is surging, offering attractive returns for investors. Industry experts are reporting increased activity in single-family home sales, with strong performance across various price ranges. This balanced, high-growth market positions Dallas as a prime spot for real estate investment. Keep up with monthly updates on the Dallas real estate market here!

Houston Real Estate Market 2025

Houston’s real estate market in 2025 presents a strong investment opportunity fueled by steady population growth, economic diversity, and competitive living costs. With rising demand for both rental properties and homes, investors have plenty of profitable prospects to explore. Early reports from industry experts show a surge in single-family home sales and vibrant activity across various price points. This healthy balance of supply and demand points to continued growth. Stay informed with monthly updates on Houston’s dynamic real estate market here!

Catalyst Funding: Areas We Serve as a Trusted Hard Money Lender

Looking for fast, reliable funding to invest in top Texas markets like Houston, Dallas, San Antonio, or Austin? Catalyst Funding is a trusted hard money lender serving real estate investors across Texas, including Houston, Dallas, San Antonio, and Austin. We offer fast, flexible hard money loans for property acquisitions, renovations, and long-term investments. Our expert team provides tailored financing solutions such as bridge loans, rental property loans, and cash-out refinances. With quick turn times, dedicated loan officers, and a secure borrower portal, Catalyst Funding helps investors close deals efficiently and grow their portfolios. Learn how we can support your real estate investment success today!